Enrolled Agent FREE Training Material

Join Us Today !

Explore Comprehensive Tax Resources for the Enrolled Agent Exam

Welcome to the Credix EA Exam Preparation page! Our goal is to help you pass all three parts of the IRS Special Enrollment Examination (SEE) with confidence and clarity.

Flash Cards

Quickly master key tax terms and concepts with our easy-to-use, flashcards designed for rapid review and retention.

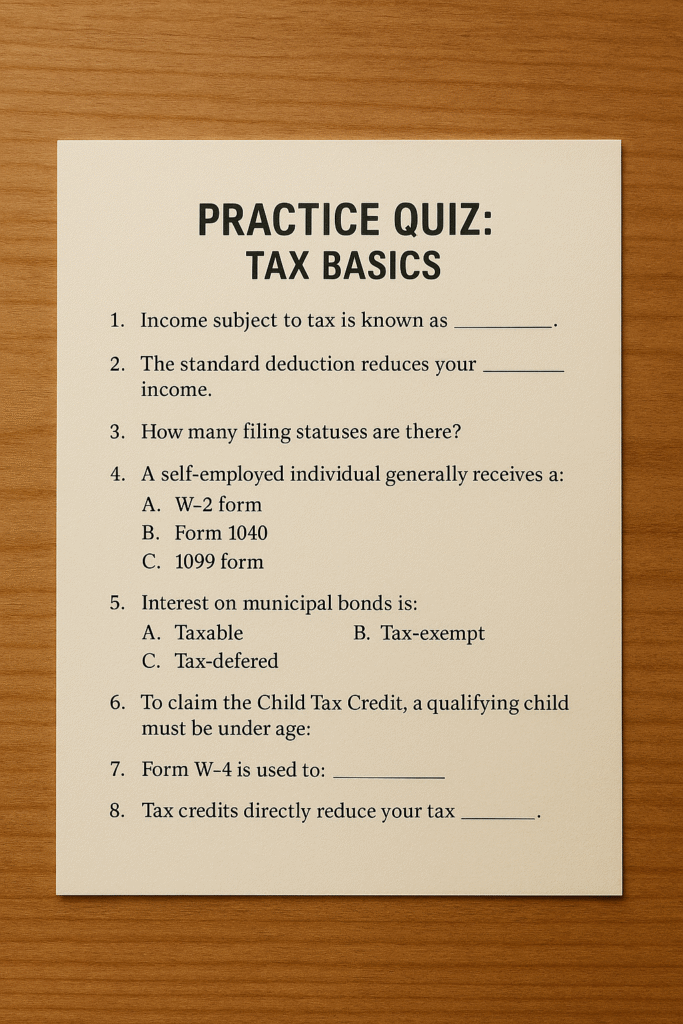

Practice Quiz

Assess your knowledge with targeted quiz questions that help you pinpoint strengths and gaps before you file.

EA Exam Pass Rates

| Part | 2022 | 2023 | 2024 |

| Part 1: Individuals | 60% | 58% | 59% |

| Part 2: Businesses | 69% | 68% | 71% |

| Part 3: Representation, Practices and Procedures | 70% | 71% | 72% |

Part 1: Individuals

This section describes the key features briefly of this part of the exam.

Gross Income & Adjustments

The exam tests your knowledge of all sources of individual income and adjustments, including wages, interest, dividends, and above-the-line deductions like IRA contributions and health savings accounts.

Deductions & Credits

You’ll need to distinguish between the standard deduction and itemized deductions (Schedule A) and understand how credits such as the Child Tax Credit and Education Credits reduce a taxpayer’s liability.

Tax Calculation & Filing

Calculating taxable income requires applying the correct tax-rate schedules, selecting the appropriate filing status, and navigating dependency rules.

Property Transactions

You must recognize how to determine gain or loss on property transactions, adjust basis for improvements or depreciation, and apply exclusion rules for a personal residence.

.

Part 2: Businesses

This section describes the key features briefly of this part of the exam.

Entity Types & Formation

You’ll identify the tax implications of different entity types—sole proprietorships, partnerships, S and C corporations, and LLCs—and how formation or liquidation transactions are treated.

Business Income & Deductions

Business income and deductions cover ordinary versus capital receipts, allowable expense recognition, and depreciation methods including Section 179 expensing and amortization.

Distributions & Basis

Understanding distributions means tracking partner or shareholder basis adjustments, guaranteed payments, and distinguishing between taxable dividends and returns of capital.

Special Topics

Special topics include setting up and reporting retirement plans (SEP, SIMPLE, 401(k)), choosing accounting methods (cash vs. accrual), and selecting a tax year.

.

Part 3: Ethics

This section describes the key features briefly of this part of the exam.

Practitioner Rules

(Circular 230)

Circular 230 rules establish practitioner eligibility, duties, due diligence standards, and potential sanctions for IRS-authorized representatives.

Taxpayer Representation Rights

Taxpayer representation rights focus on executing and filing Power of Attorney (Form 2848) and defining the scope of actions a practitioner may take on a client’s behalf.

IRS Processes & Appeals

The exam evaluates your grasp of IRS processes, from audits and appeals to collections procedures like Offers in Compromise, Installment Agreements, and Collection Due Process hearings.

Special Topics

You must be familiar with confidentiality requirements under Section 6103, identify ethical pitfalls, and recognize penalties for misconduct, conflicts of interest, and non-compliance.

.